What to know before refinancing your home equity loan

With the Federal Reserve’s recent action to lower the federal funds rate and home loan rates trending downward in recent months, the interest outlook is turning the corner. Consequently, many homeowners who had been waiting for lower rates have now tapped into their home’s equity for cash.

Since home equity loans are secured by your home, they often come with more favorable interest rates than credit cards and personal loans. A home equity loan refinance can be a wise choice if your current loan has a higher interest rate than what’s available today. As of October 15, the average home equity loan rate is 8.36%.

Even a slight rate drop of half a point to a point may save you tens of thousands of dollars over your loan term, depending on your loan amount, bank and other factors. But if you’re considering this option, there are some things you should know before proceeding.

See what new home equity loan rate you could qualify for here.

What to know before refinancing your home equity loan

Ready to refinance your existing home equity loan? Remember these five things before you do:

Shop around for the best rate

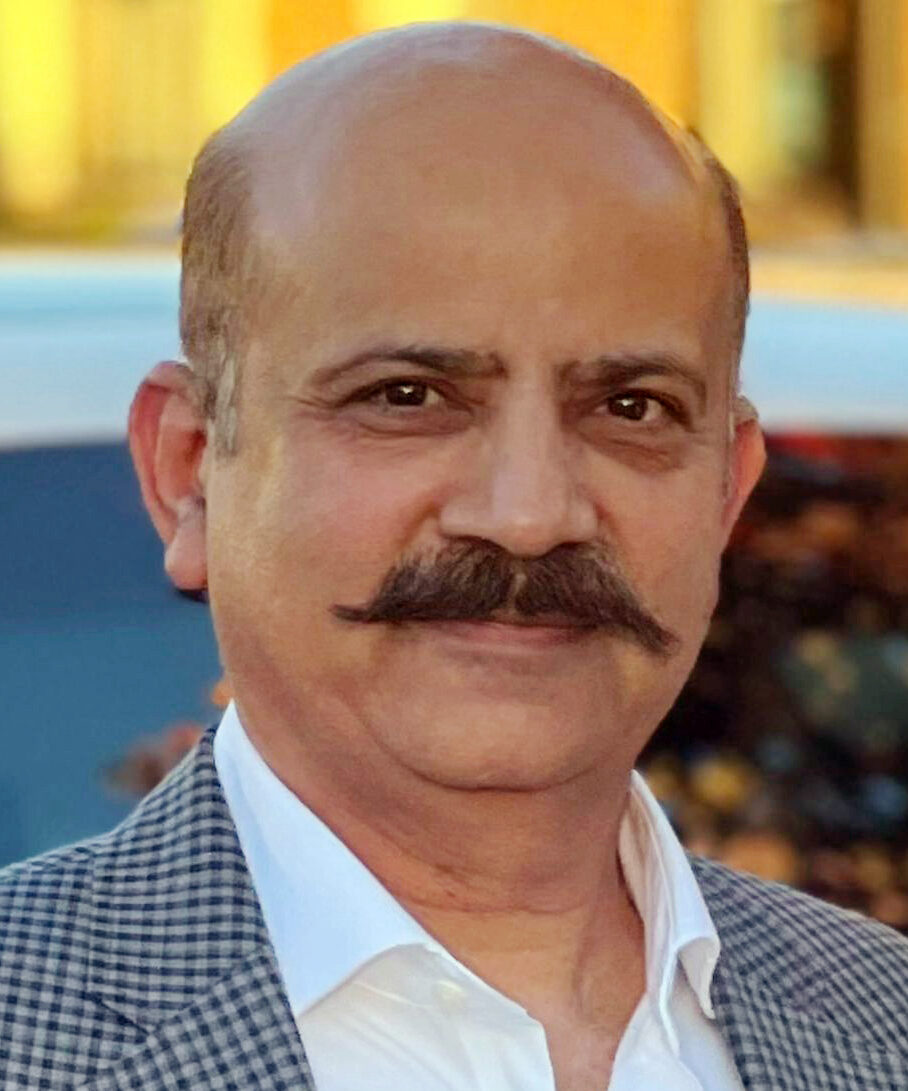

Remember, home equity loan rates can vary widely from lender to lender. As such, it’s wise to compare quotes from multiple lenders to improve your odds of landing the best refinance interest rate.

According to Aaron Gordon, branch manager and senior mortgage loan officer at Guild Mortgage, skipping this critical step is the most common mistake homeowners make. “Start with the bank or credit union you have a current banking relationship with and then contact one or two other non-bank lenders.”

Start exploring your home equity loan options online now.

Home equity and credit score matter

As Gordon notes, your home equity and credit score also factor heavily into the refinance rate you receive on a home equity loan. Higher credit scores generally lead to more favorable rates—the lower, the better. However, you can still refinance with a lower credit score, but your rate may be higher.

“Home equity lenders look at your credit score and the amount of home equity you have when pricing your loan,” he says. “The more equity you’ll keep in the home after this loan will get you a better rate.”

Overborrowing could have serious consequences

When you refinance, you essentially take out a new loan at a lower rate than your current one. Right now, with rates falling, it could be tempting to overborrow. Home equity loans and lines of credit are considered second mortgages that use your home as collateral for the loan. Consequently, your lender could foreclose on your property if you fall behind on your payments. That’s why it’s essential not to overborrow, even at today’s lower rates, and to make sure you can comfortably afford the monthly payments.

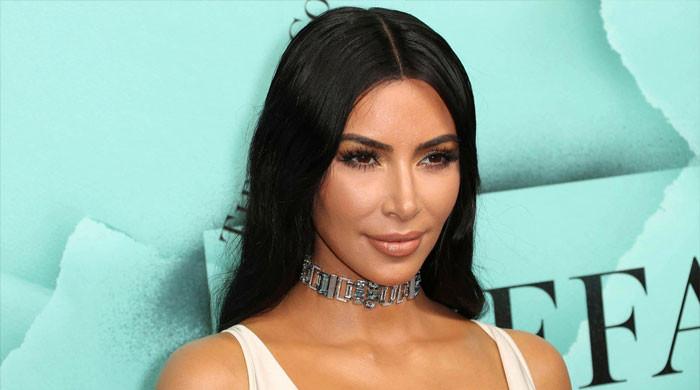

“A home equity loan can be a powerful tool in making extensive and expensive upgrades to your house to hopefully add value to your property, but it can also be incredibly risky if not executed properly,” says Alex Beene, a financial literacy instructor for the University of Tennessee at Martin. “The amount borrowed needs to be manageable and fairly uncomplicated to pay back over time at your existing income level.”

Other considerations

Home equity loans are a popular lending option, in part because you can use the money to improve your financial profile. Many borrowers use the funds to consolidate debt or for home improvement projects that boost their home’s value.

As Beene notes, “If you’re not using the amount to in some way add financial value to your net worth, it’s not a smart decision. Home equity can be a tool for using additional financial resources to boost your home’s value long-term, among other things. However, if you’re looking at it as just a fresh injection of cash to get what you want, you’re probably not doing it for the right reasons.”

The bottom line

Most lenders allow you to borrow up to 85% of your home’s value. However, the amount you might borrow should take into account your unique financial situation. It’s imperative to borrow only what you can comfortably afford now and over the loan term, even if today’s lower rates make it tempting to withdraw more equity.

Matt Richardson is the managing editor for the Managing Your Money section for CBSNews.com. He writes and edits content about personal finance ranging from savings to investing to insurance.